| When foreign investors invest in a business, it is crucial to differentiate between two types of investment: holding no more than 49% of shares or holding 50% or more of shares. If foreigners hold a majority of the shares, the registration process becomes a little more complex. Companies raising funds can use FlowAccount to record transactions via the “Accounting” menu. Additionally, FlowAccount offers online company registration services for your convenience. |

No Capital? Starting a Business Is Easier Now

Lacking funds is no longer a significant obstacle as there are multiple funding sources available, such as banks or foreign investors. This may lead to common questions: Is it difficult to raise funds from foreign investors? Can foreigners become shareholders? What are the procedures involved? This guide will walk you through the steps in detail.

เลือกอ่านได้เลย!

ToggleTypes of Companies with Foreign Shareholders

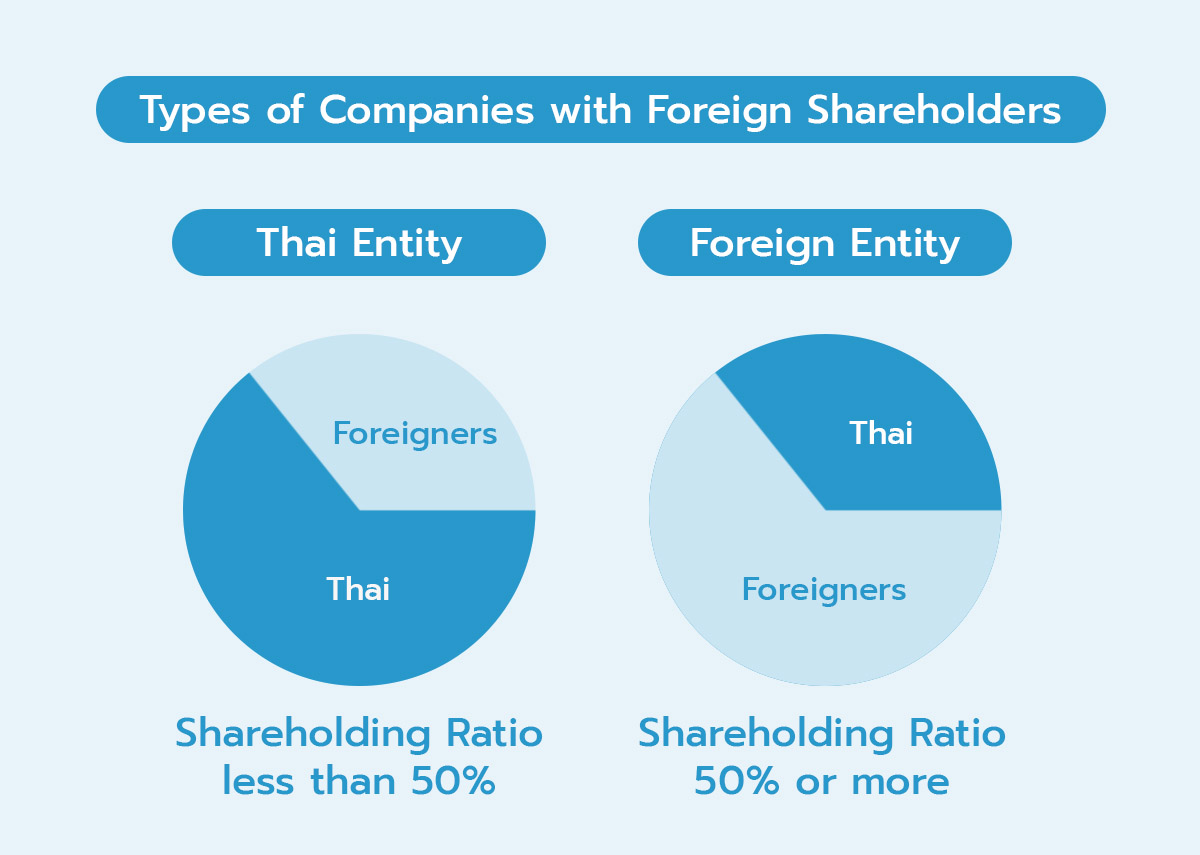

Companies with foreign shareholders fall into two categories:

- Foreigners holding no more than 49% of shares :

The company is still considered a Thai legal entity in this case. - Foreigners holding 50% or more of shares :

The company is classified as a “foreign entity,” subject to additional restrictions such as:

- Applying for a Foreign Business License (FBL)

- Prohibition on land ownership

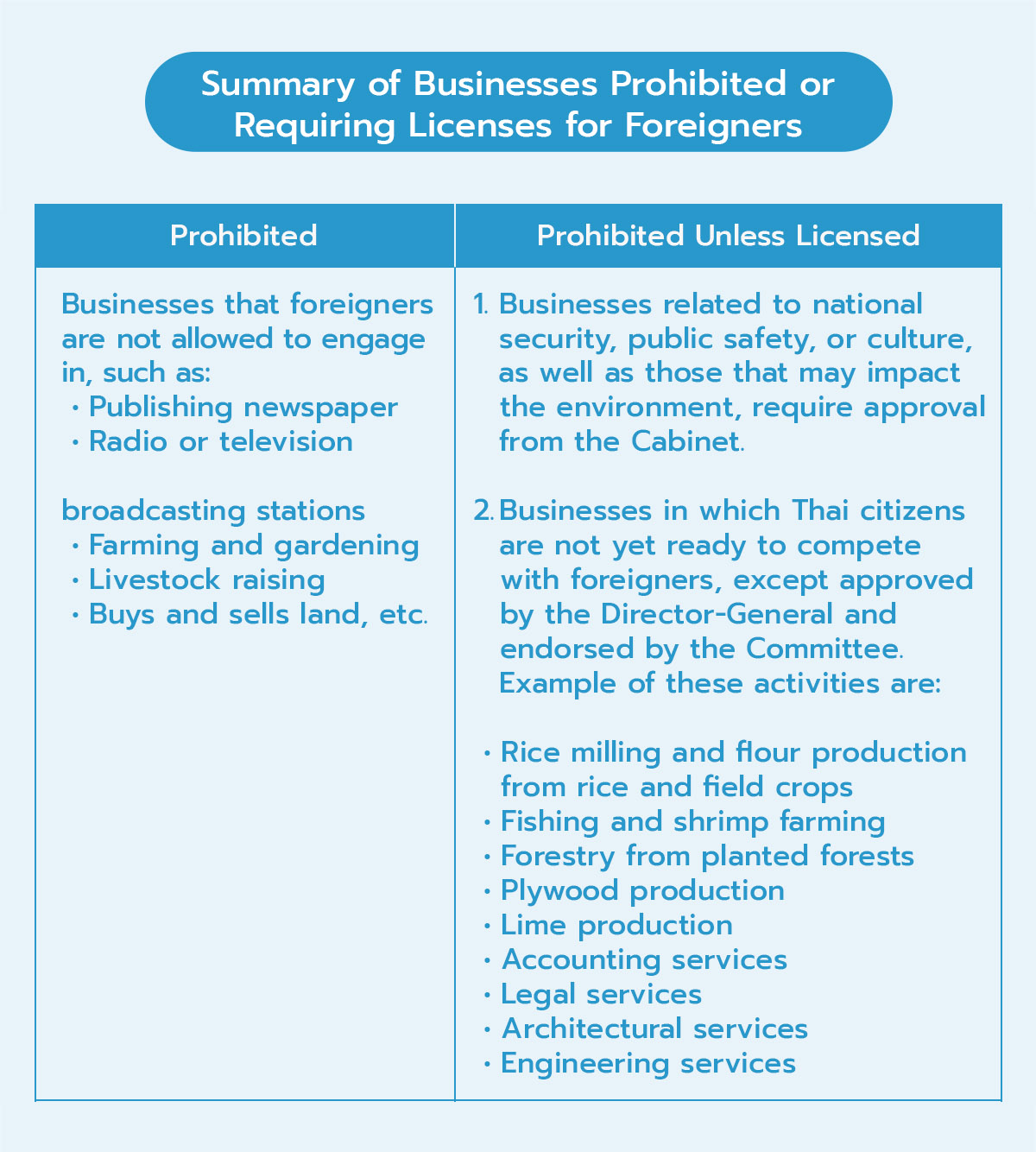

- Limitations on business activities under the Foreign Business Act as follow:

As you can see, it’s quite clear that if foreigners hold 50% or more of the shares, there are significant restrictions and complexities that require further understanding.

Can Foreigners Hold 100% of Shares? What Are the Requirements?

Foreign investors can legally own 100% of shares in a company registered in Thailand, provided they meet specific conditions, such as:

- Applying for a Foreign Business License (FBL)

- Foreign nationals or businesses receiving investment promotion from the BOI (Board of Investment) may apply for a Foreign Business Certificate.

- Under Section 11 of the Foreign Business Act B.E. 2542 (1999), foreign nationals or businesses from countries that have treaties, agreements, or obligations with Thailand may apply for a Foreign Business Certificate.

Recording Capital in FlowAccount

Recording capital contributions is straightforward using FlowAccount. Use the “Accounting” > “Journal Voucher” menu to log capital received on any given date. This streamlined process helps business owners manage financial documentation effectively.

Required Documents for Registering a Company with Foreign Shareholders

When registering a company with foreign shareholders, the required documents differ from those for a regular Thai company. The following documents must be prepared:

- Application for Foreign Business License (Form T.2)

- Reserved company name

- Copy of house registration

- Consent letter for using the premises and a copy of the householder’s ID card

- Detailed description of the business type for which the foreign business license is requested

- Information on the capital, shares, and shareholding ratio, including the breakdown of shares between Thai and foreign shareholders

- Copies of the Thai shareholders’ ID cards or foreign shareholders’ passports, including details of addresses and the number of shares held by each shareholder, with at least three company founders, and signatures of all founders.

- Proof of the paid-up capital within 12 days (for businesses with registered capital exceeding 5 million THB).

- Evidence of the origin of funds for Thai shareholders, in alignment with the paid-up capital (applies to new businesses with foreign investors in a company limited or when a foreigner has authority over the company).

- Bank deposit certificate of Thai shareholder with a deposit not less than the amount they have invested (for businesses with both Thai and foreign investors).

Steps for Registering a Company with Foreign Shareholders Online

Registering a company online has become easier and more convenient. You can complete the registration through the electronic registration system (e-Registration) provided by the Department of Business Development. The steps are as follows:

- Register and verify your identity: The founder registers and verifies their identity, then receives a username and password.

- Fill out company details: Enter the necessary information for the company to be registered in the e-registration system.

- Wait for registrar approval: The registrar will review the submission.

- Sign electronically: Once approved, the registrar will send an email with the registration details and password for the directors and shareholders to sign electronically.

- Pay the registration fee: Complete the payment for the registration fee.

For further details, you can follow the steps in the DBD e-Registration system or contact FlowAccount for online company registration services.

When investing in a business in Thailand as a foreign investor, it’s essential to distinguish between holding less than 50% of shares or more than 50%, as the latter involves more complex registration procedures. In such cases, it is advisable to understand the conditions thoroughly and seek expert assistance to ensure proper registration and compliance with Thai laws.

Regardless of the nationality of shareholders, FlowAccount can assist with online company registration

FlowAccount offers services for setting up legal entities, along with an online accounting program and benefits, helping businesses operate confidently from the start. We provide 9 services to ensure the preparation of all necessary documents in compliance with the Department of Business Development’s regulations. For more details, please visit here.

New entrepreneurs can try FlowAccount’s services for 30 days for free or sign up for a package starting at just 165 THB per month, with unlimited documents and mobile app access.

About Author

Certified Public Accountant (CPA) Thailand with experience as an external auditor for listed companies who aspires to make accounting easy and accessible for everyone.

Apply to be a writer for FlowAccount here.