It's easier to create a tax invoice than you think!

Download FlowAccount, the mobile application for tax invoice in Thailand.

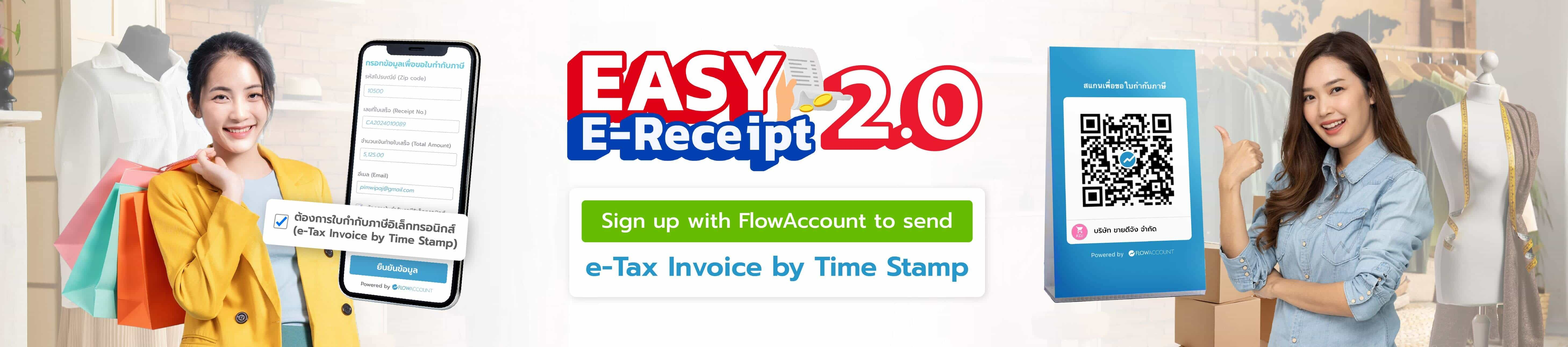

Digitize your taxation with an e-Tax Invoice by Time Stamp to save time sending bills to your customers.

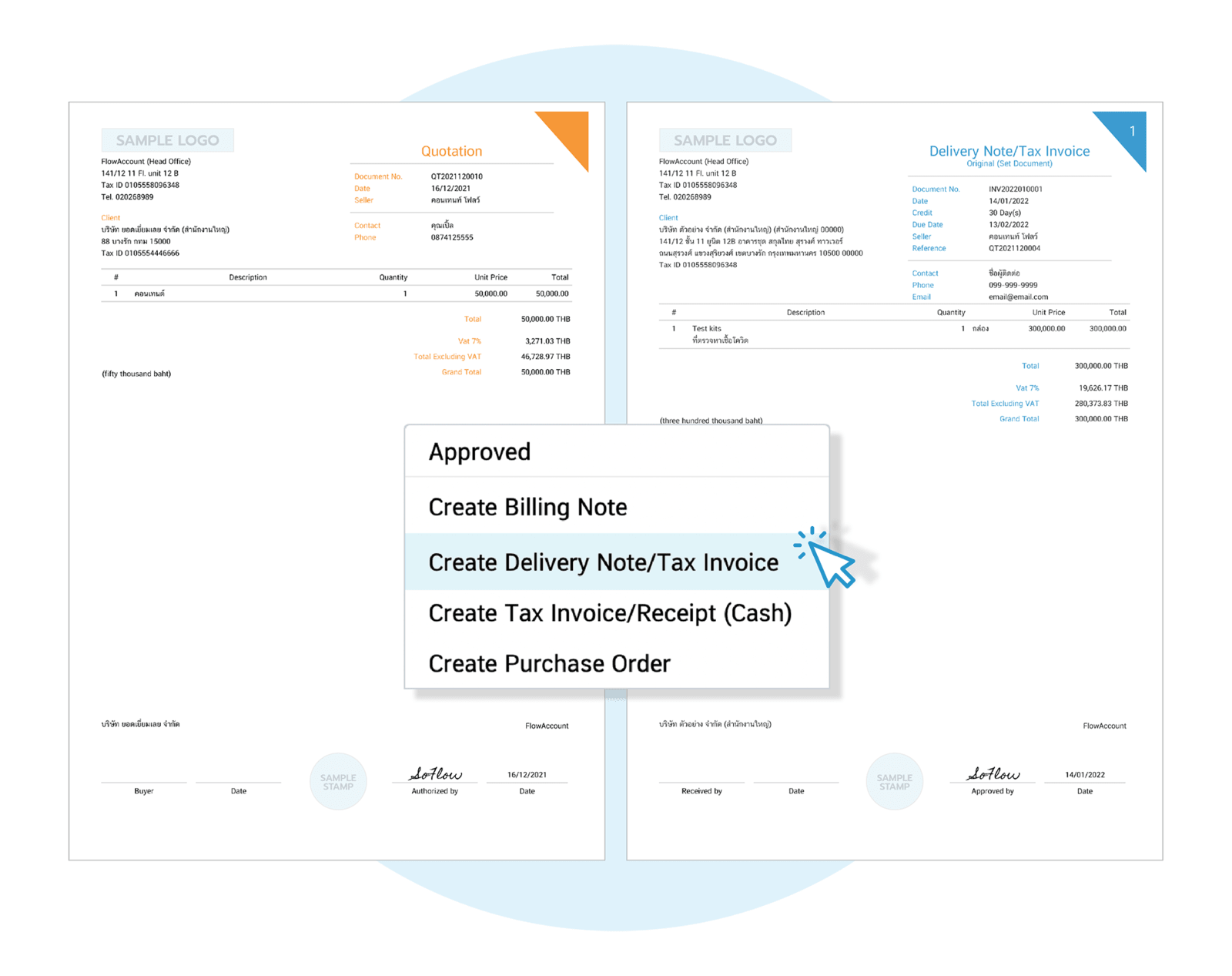

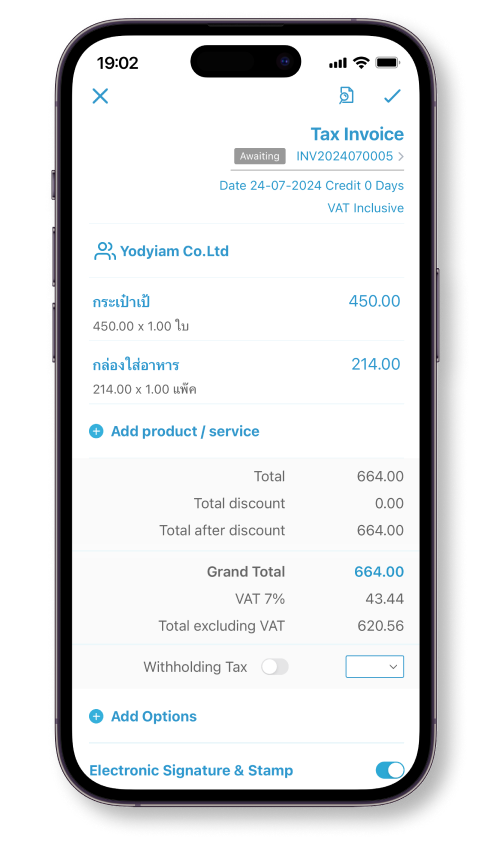

Create a tax invoice from a quotation or billing note with just one click or tap.

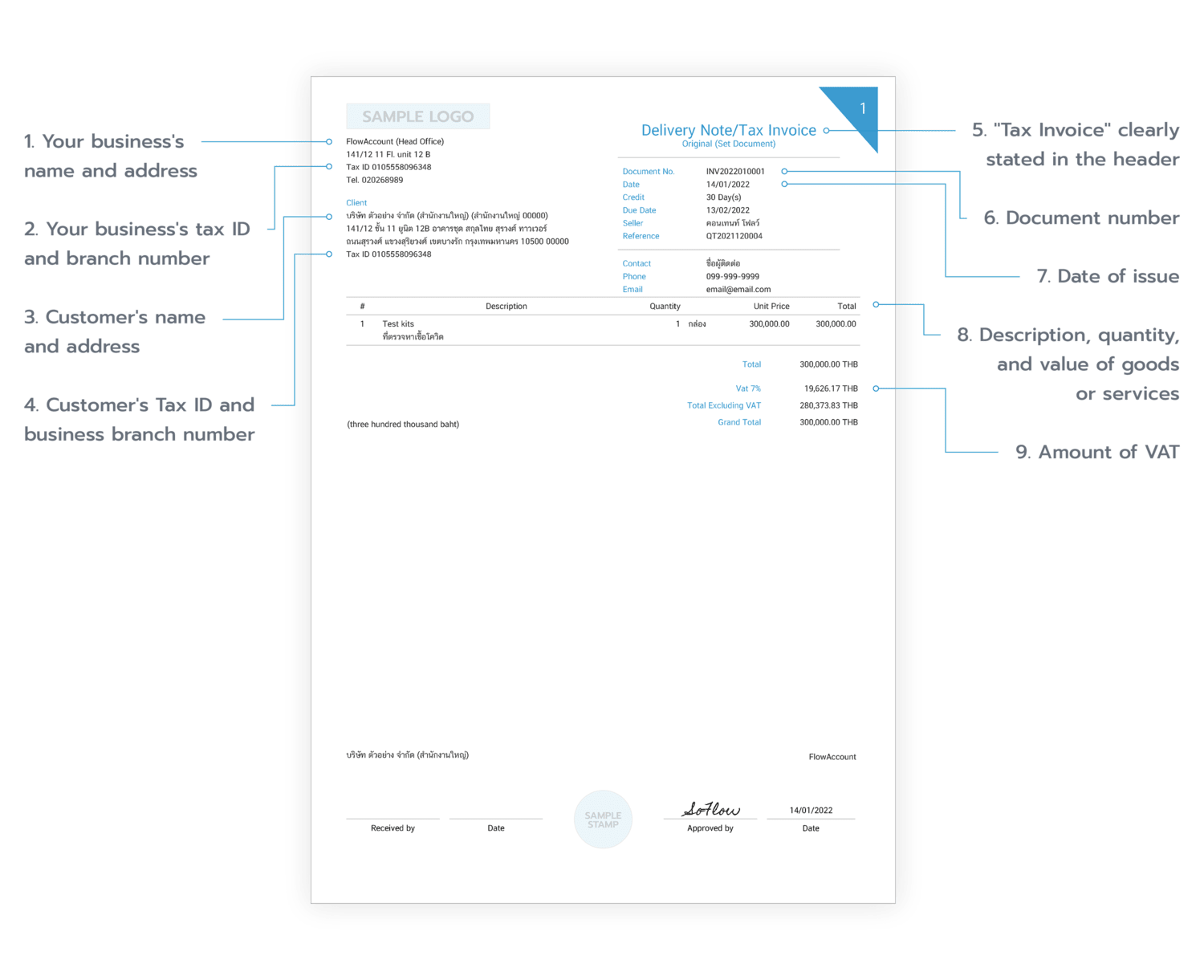

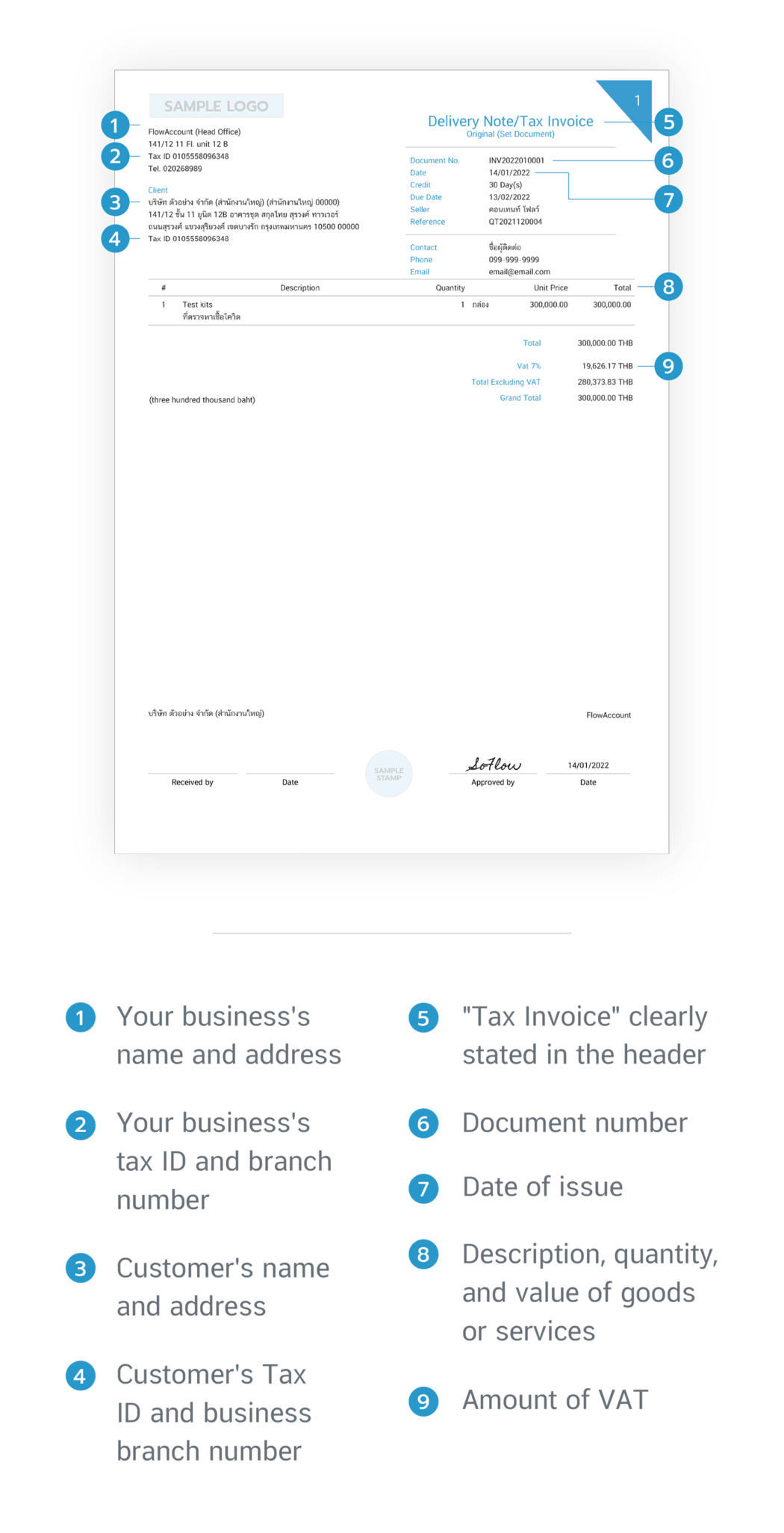

Quickly search the Thailand Revenue Department database for essential customer contact and tax information using FlowAccount, your trusted tax invoice software in Thailand.

Get your documents under control with FlowAccount's auto-numbering system.

Just made a sale? Issue a tax invoice and FlowAccount updates your inventory for you.

Link your FlowAccount with Lazada, Shopee, and FoodStory to generate tax invoices automatically

Ditch your POS. All you need is a printer connected to a laptop or smart phone.

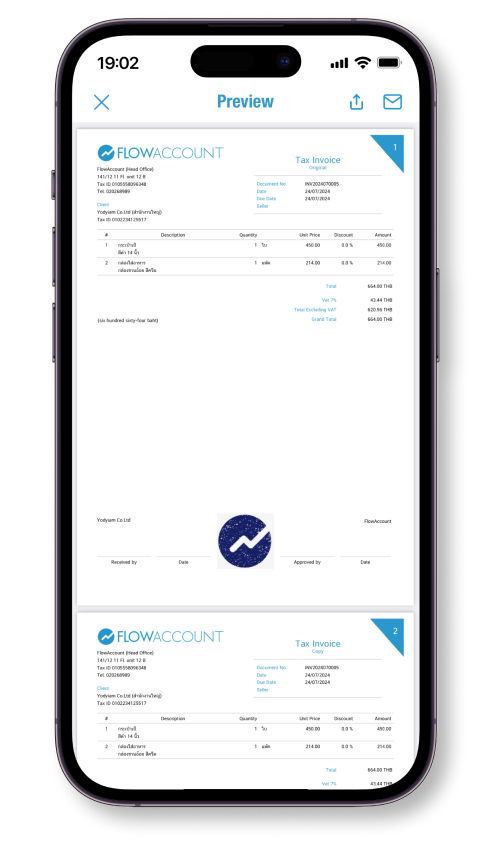

Preview or send documents as PDFS or links directly to your customers from FlowAccount.

Download FlowAccount, the mobile application for tax invoice in Thailand.

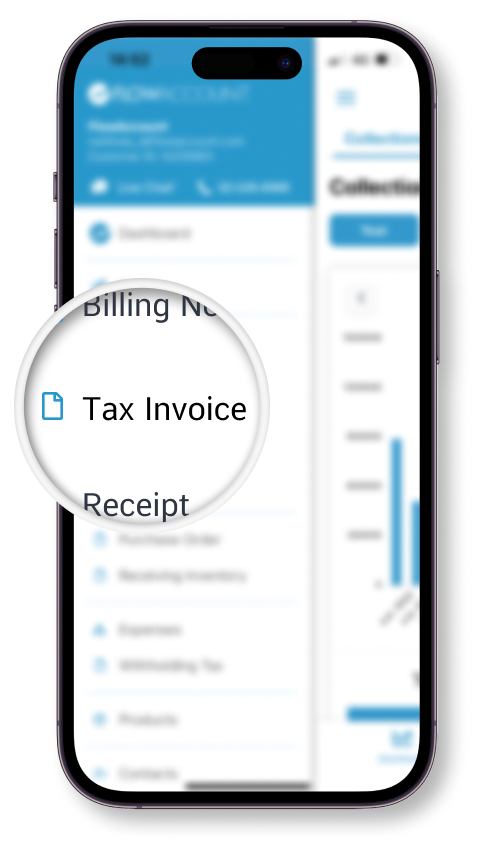

Create Tax Invoice via mobile app

Create Tax Invoice via mobile app

Frequently Asked Questions

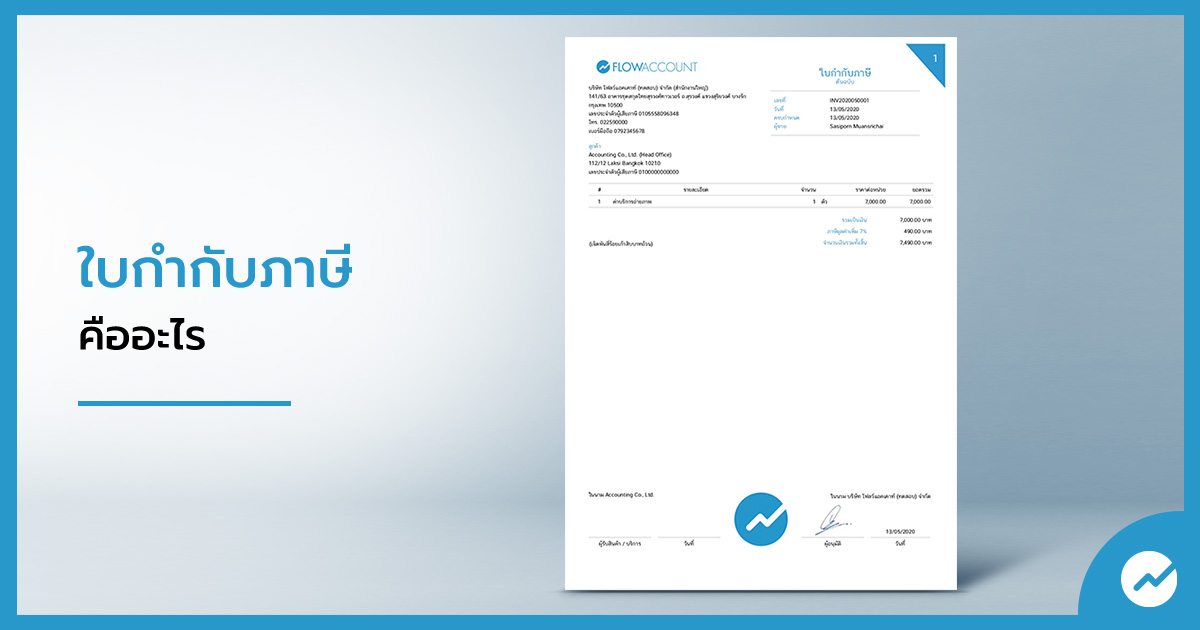

What businesses benefit from FlowAccount's VAT features?

Who has the right to issue tax invoices?

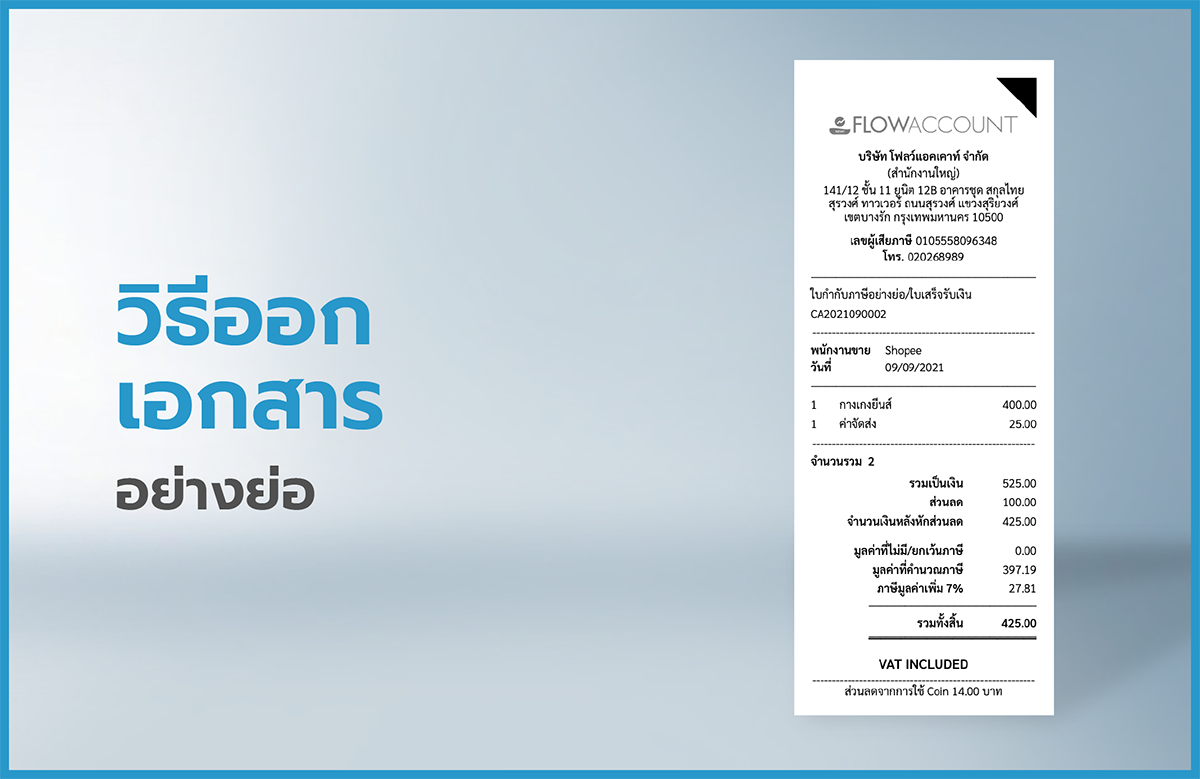

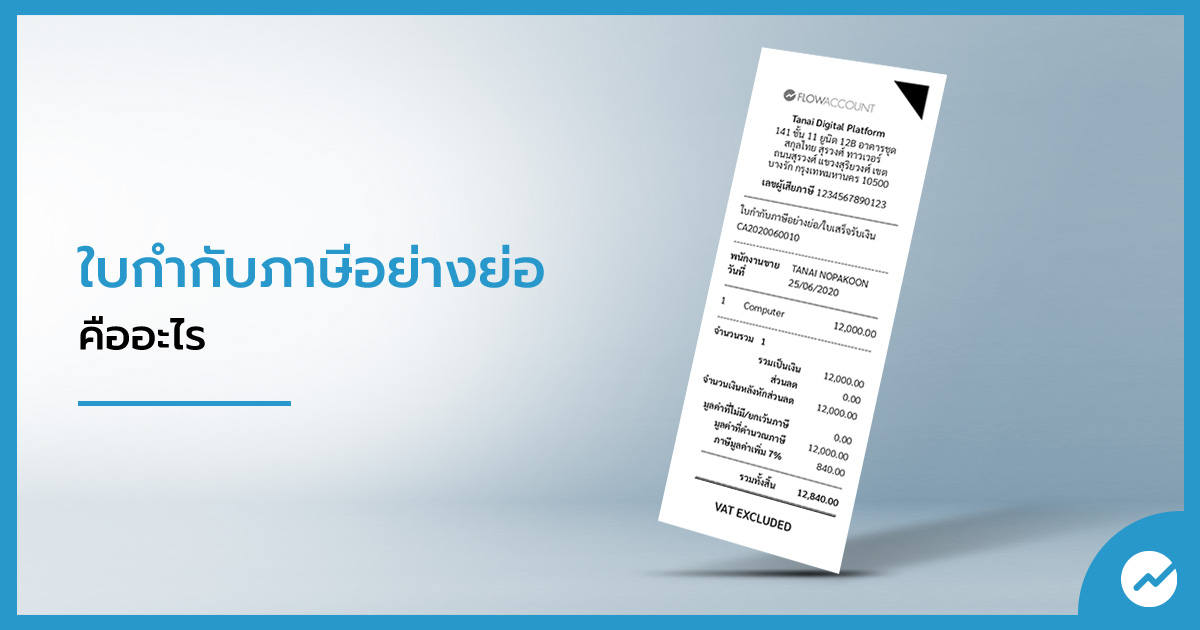

What is the difference between a full tax invoice and an abbreviated tax invoice

- Your business address is not required.

- Your customer's name and address are not required.

- Goods or services can be listed simply as codes (i.e., no description necessary.)

- VAT must be included in the prices along with a statement, "Prices include VAT". (However, VAT amounts may be displayed separately from prices, if needed.)

What is E-Tax Invoice by Time Stamp?

and receipts issued via FlowAccount