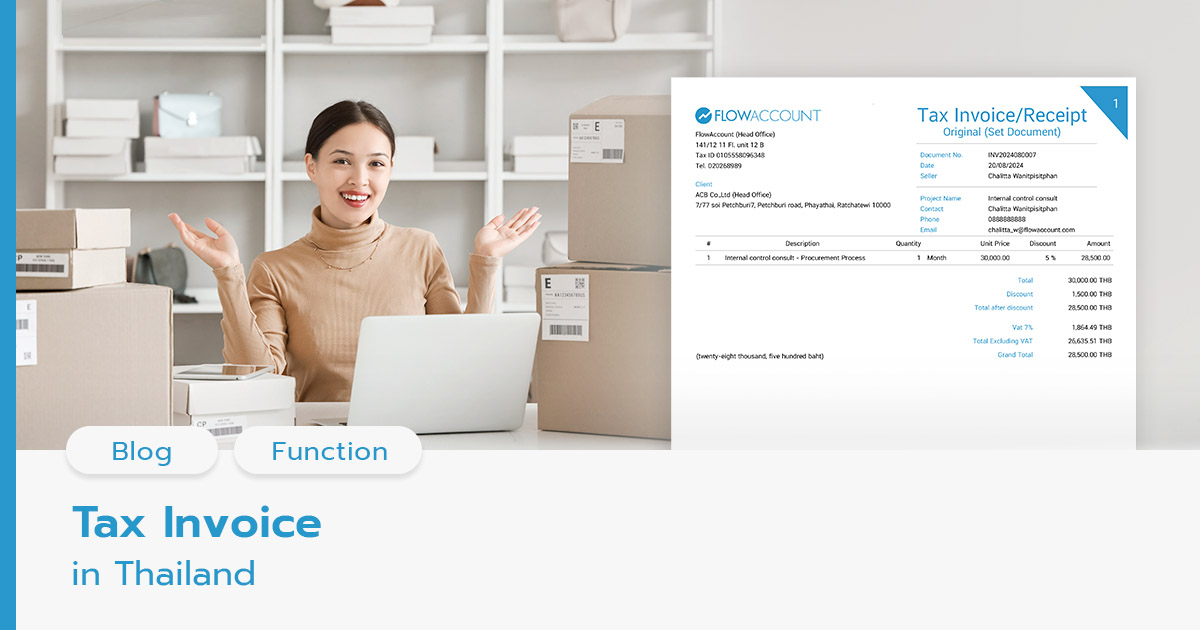

| Most people have seen tax invoices but not everyone understands its purpose and who has the responsibility to issue them. If you are doing business in Thailand, this article is essential for you. |

What is Tax Invoice in Thailand

Tax invoice is an important document for those under the Value Added Tax (VAT) system. It is a required document for business owners who have already registered for Value Added Tax (VAT) to issue a tax invoice for clients once a product is sold or service is rendered. This is to show the value of the products or services and the Value Added Tax collected from the clients.

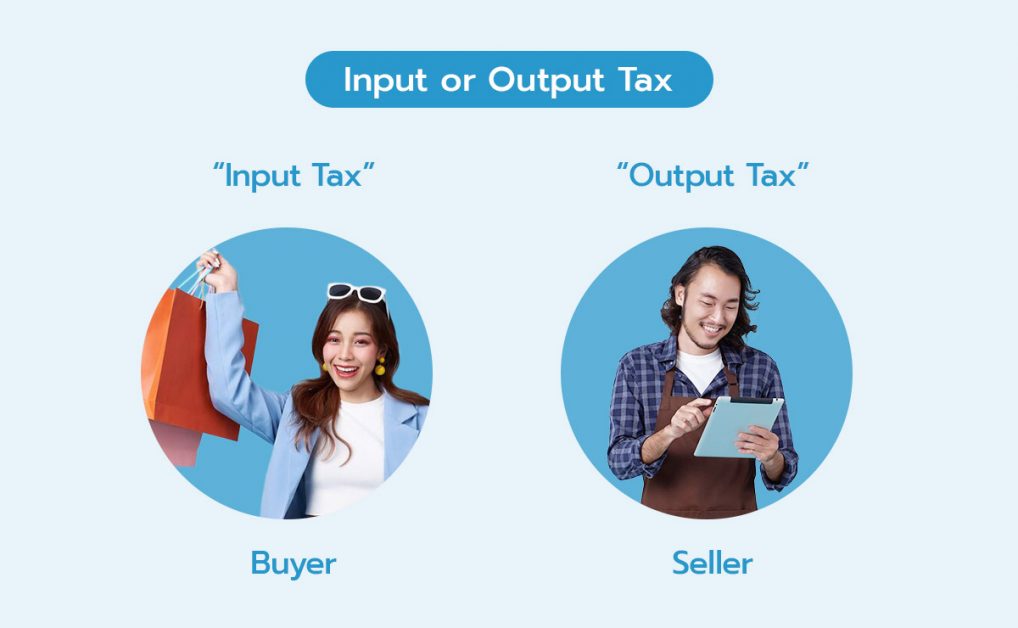

The Value Added Tax is calculated based on selling price. If you are a seller, it’s called “ Output Tax”. If you are a buyer, it’s called “ Input Tax”

เลือกอ่านได้เลย!

ToggleWho is responsible for issuing a tax invoice

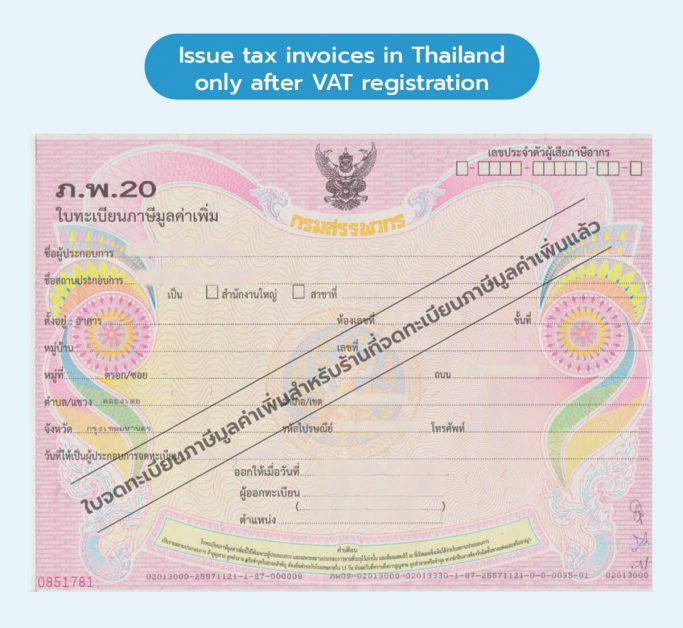

If you, as a person or as an entity, have a gross income of 1,800,000 Baht or more per year, you need to register for Value Added Tax with the Revenue Department within 30 days from the day your income exceeded 1,800,000 Baht.

If your income has not reached 1,800,000 Baht yet, you can choose to register for VAT as well. However, the pros and cons of VAT registration should be carefully considered.

You are only entitled to issue tax invoices once you have registered for VAT and received PP20.

When to issue a tax invoice

- In case of a sale of a product

The seller is responsible for issuing a tax invoice once the product is delivered to the buyer even when you have not received payment

- In case of providing a service

The service provider is responsible for issuing a tax invoice once the payment is made. The point of issuing differs from a sale of a product because a service is intangible, thus, payment is being used as a tax invoice issuing criteria.

What are the types of Tax Invoice

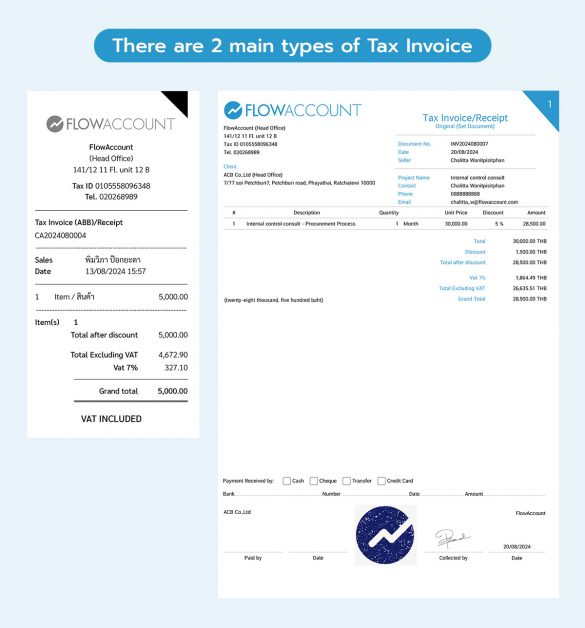

There are 2 main types of tax invoice

- Abbreviated Tax Invoice (ABB)

- Full Format Tax Invoice

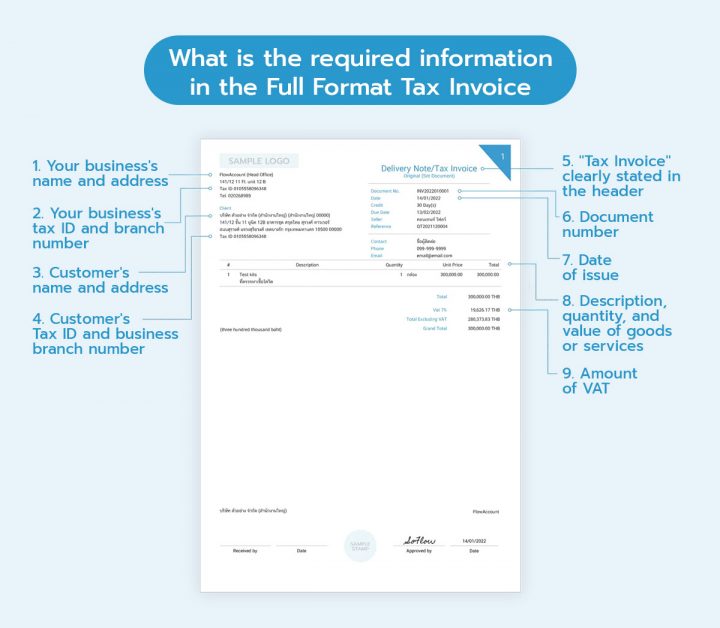

What is the required information in the Full Format Tax Invoice

- Name and Address of the seller or the service provider

- Tax ID and branch number of the seller

- Name and Address of the buyer or the service recipient

- Tax ID and branch number of the buyer

- The term “Tax Invoice” must be clearly visible

- Tax invoice reference number

- Date of issue

- Details of the Product/Service, including description, quantity, unit price and total value

- VAT amount must be separated from the product/service value and is clearly visible

- Others stipulated by the Director-General of the Revenue Department for entities

10.1 States “ Head Office” or “ Branch No.” of the seller or the service provider

10.2 Tax ID of the buyer or the service recipient ( especially those under VAT system)

10.3 States “ Head Office” or “ Branch No.” of the buyer or the service recipient

VAT Registered personal or entity is responsible to issue full format tax invoice to buyer or service recipient.

How to deal with clients outside the VAT system

Some of your clients might not be under the VAT system or might not want to share their sensitive information such as tax ID. No matter who your client is, you are responsible to issue a tax invoice. However, simply obtaining their names and addresses are enough.

You need to ensure that you have their names and addresses. If your tax invoice does not contain the required information, there will be penalty charges by the Revenue Department. Therefore, it is recommended to prepare a form for clients to fill in their required information.

It can be overwhelming to manage tax invoices but FlowAccount is ready to help you with these documents

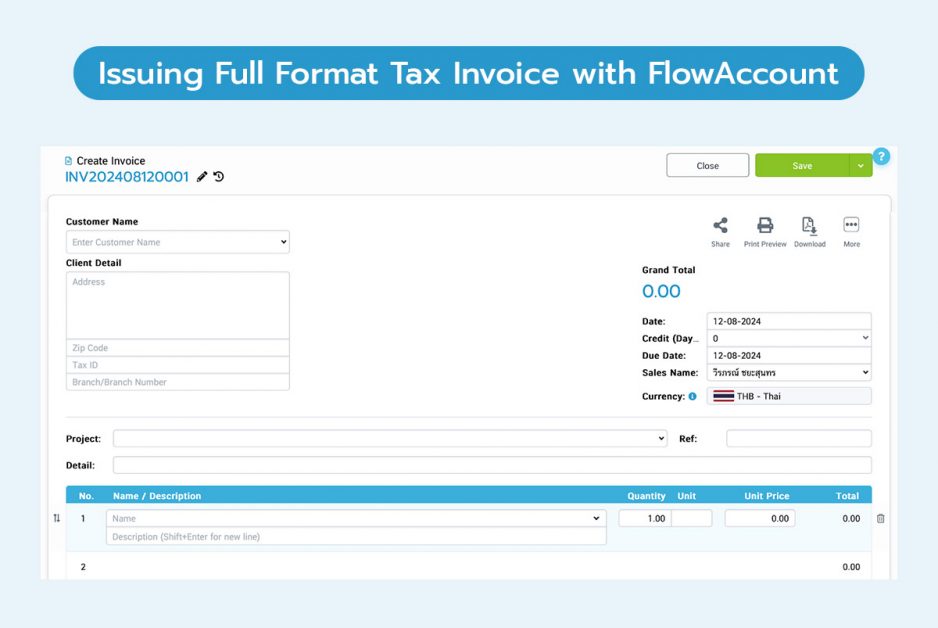

Issuing Full Format Tax Invoice with FlowAccount

Full format tax invoice is simple with FlowAccount. Try it for free by sign up here

Once you are signed up, visit the “Sell” section > Invoice > Create New.

- Fill in the Company Name, Address and Tax ID of the buyer or the service recipient, including contact person information such as name, contact number and email address. If the client information is already in the database, the system will automatically show the details during filling. If it is not yet in the database, the system will store this information in the database for future reference.

- Document reference number (Auto-generated by the system)

- Select Document date (Can be changed based on reference document)

- Select Price of the product or the service (Can choose to use included or excluded VAT)

- Fill in details of the Product/Service, including description, quantity, unit price. If the product information is already in the database, the system will automatically show the details during filling.

- Total value and Value Added Tax amount (Auto-calculated by the system)

Once you have completed these simple steps, a tax invoice with required information by the Revenue Department will be generated for you. On top, you can select to print out the document, download it as a PDF file, send it as an email or share as a link to the client.

About Author

Certified Public Accountant (CPA) Thailand with experience as an external auditor for listed companies who aspires to make accounting easy and accessible for everyone.

Apply to be a writer for FlowAccount here.