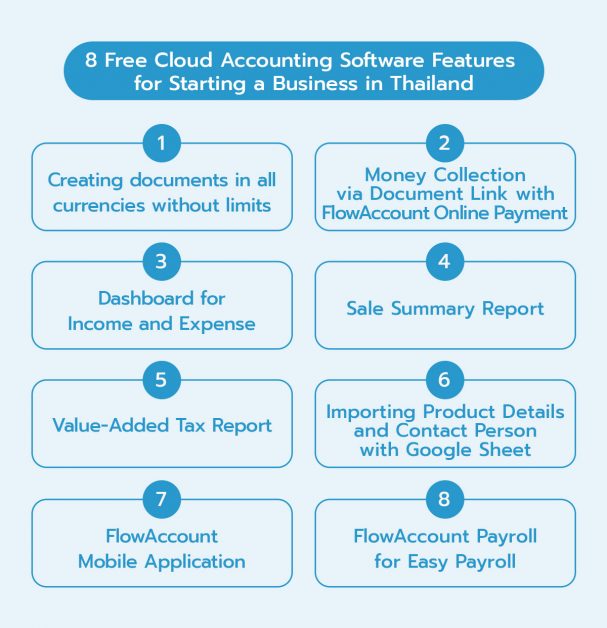

| FlowAccount is a Thai Cloud Accounting Software offering solutions from creating business documents to automating accounting records to help with business operations. Read more about the 8 features from the free package are made available for new entrepreneurs, online business owners, or freelance. |

If you are freelancing or starting a business in Thailand, you can use a basic package from FlowAccount where primary features are available for free.

FlowAccount is a Thai Cloud Accounting Software that offers solutions to help in business operations, starting from creating business documents during a project initiation for clients to recording expenditures and payroll. Money collection by QR Code is also available so that you can share your billings and receive the money conveniently. Then, the system will automatically record accounting entries and summarise them into income and expense reports that you can have real-time access to.

All of the above will make accounting easy for you with less time in calculation, document creation, or delivering documents to your clients. Furthermore, working with multiple users as a team is made convenient with Cloud Accounting Software where everyone can have access to the same system both from a website and mobile application. Every solution offered by FlowAccount is with an aim to be a true business partner for entrepreneurs.

The Basic Package from FlowAccount is free of charge and is made available for everyone. It is full of primary accounting features that are a solution for freelancers or those who are starting a business. Let’s have a closer look at our free features!

เลือกอ่านได้เลย!

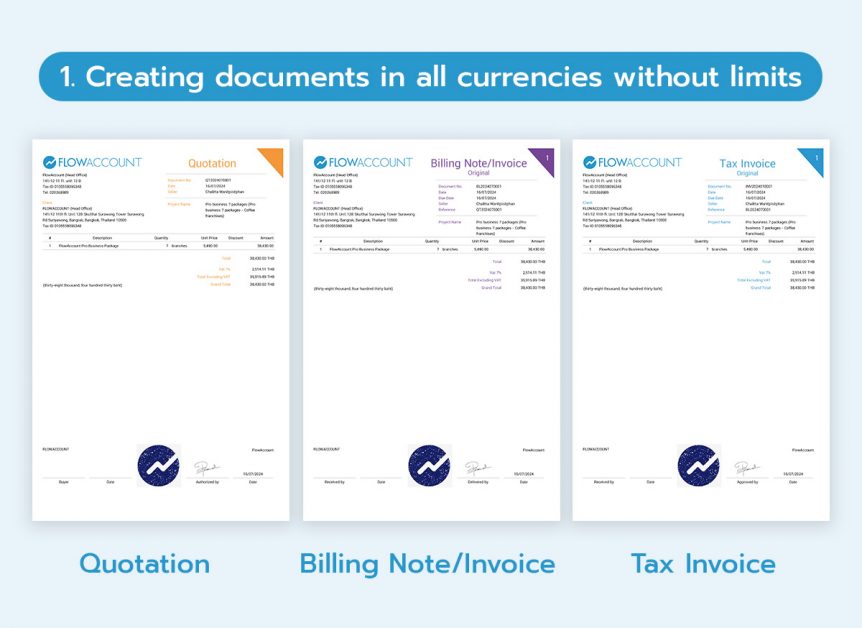

Toggle1. Creating documents in all currencies without limits

You can create unlimited billings by filling in only a few pieces of information to create professional documents within 1 minute. The document forms available for free are ;

What’s special about creating documents in FlowAccount is that it makes doing business easy for you. We eliminate repetitive tasks that are not necessary so you are only required to fill in important information ONCE during quotation. Once the quotation is issued, billing/invoice or receipt can be issued afterward without the need to re-enter information into the system. You can also select to apply Withholding Tax (WHT), Value-Added Tax (VAT), or discounts by items. Furthermore, the documents can be created in every currency or any customized currency such as digital currency.

On top, FlowAccount offers status tracking for each document whether it’s “Pending Approval”, “Completed”, ”Billing Issued”, ”Billed”, “Receipt Issued” or ”Cash Collected” which are very useful for new entrepreneurs who prefer to work systematically and professionally.

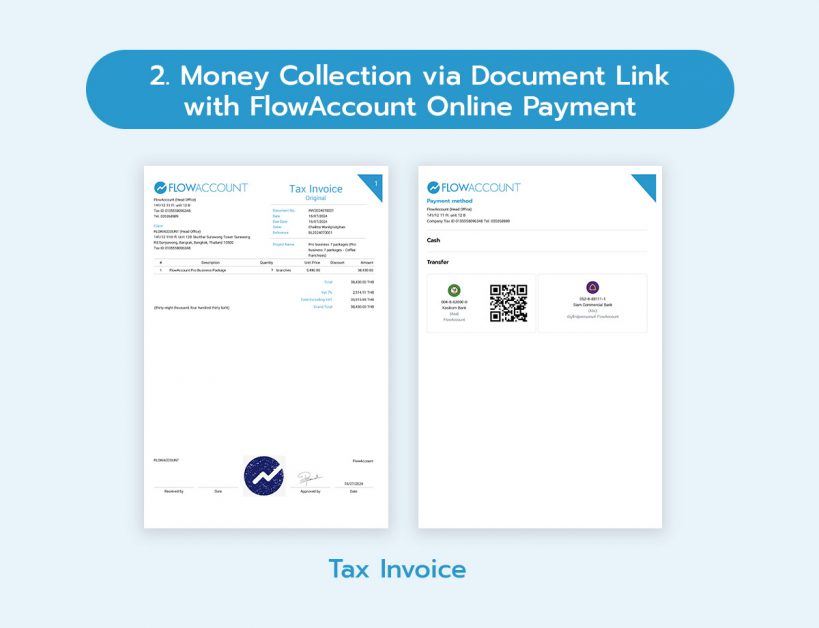

2. Money Collection via Document Link with FlowAccount Online Payment

Money collection with FlowAccount Online Payment is made convenient by generating a QR Code from FlowAccount for billings and online money collection. You can simply share links for receipts or tax invoices, clients can scan QR Code to transfer payments for the provided services/products right away. Once the payments are received, the system will record payment evidence and automatically update document status to “Cash Collected”. This will help you with the money collection process, document management, and accounting recordings.

3. Dashboard for Income and Expense

A dashboard that summarises the business in both income and expense so that you can track your business’s financial health conveniently. With real-time access to the dashboard, your business strategies can be laid out anytime and anywhere. The dashboard is designed based on data visualization concept so the information is easy to understand and consists of all important elements. The graphs are color-coded into 2 simple colors: blue and pink.

- The Blue Graph illustrates income that is calculated based on billing, invoice, tax invoice, and credit note. The data is categorized into sales, money collected, accrued income, etc.

- The Pink Graph illustrates expenses that are calculated based on expenditures, goods receipts, and payroll. The data is categorized into payments, accrued expenses, etc.

All of the information above can be viewed for a selected period to compare both income and expenses in the past. Other outstanding status are also available. This feature provides a clearer picture of your business with a variety of data viewpoints.

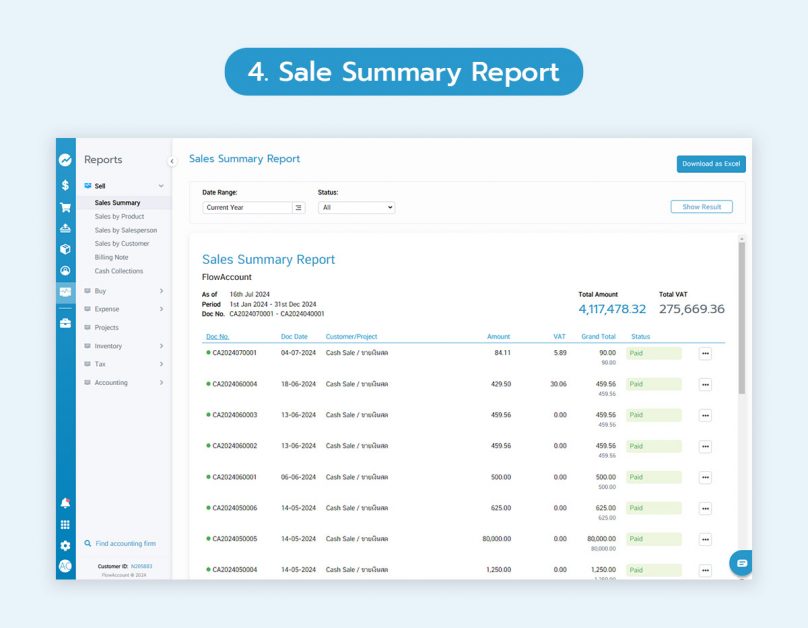

4. Sale Summary Report

When you have created documents or receipts, the system will summarise those transactions into a sale summary. The report offers information segmentation on sales by products, by clients, or even by sales staff. This will provide you with answers on which products or services are in the trend or which type of client is your key client, etc. Strategic planning on marketing is no longer difficult and you can now utilize the information to improve the sales.

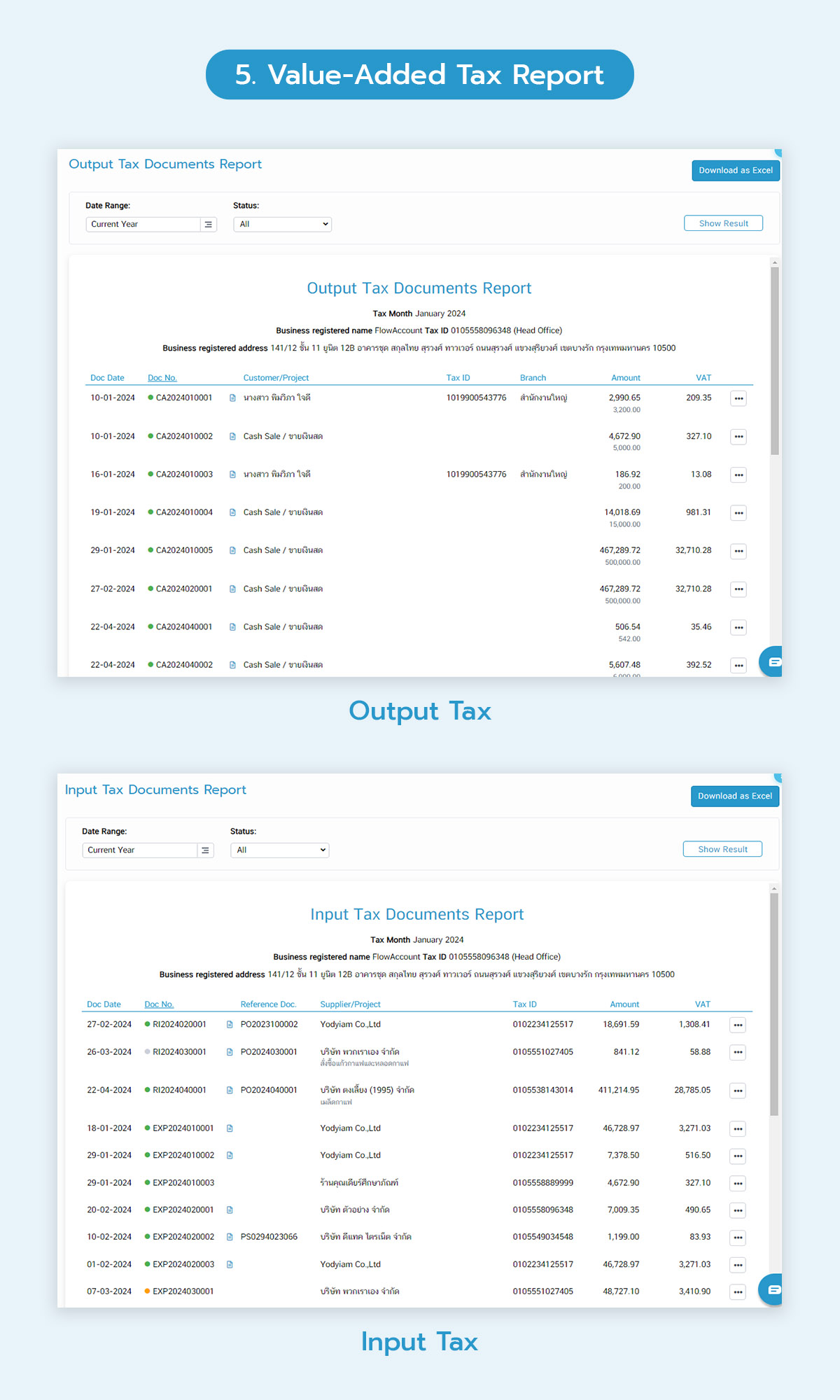

5. Value-Added Tax Report

For business owners who already registered VAT, you would have to put additional effort into monthly tax documents, both input and output tax. You can use FlowAccount to create an Output Tax report that contains details on Output Tax collected from clients. The report can be viewed according to a selected period together with document status. On top of that, you can download the report in Excel format for seamless data transfer to your accountants or accounting firm.

If you are using FlowAccount’s Standard Package, you will have access to the Value-Added Tax management feature which helps you check if there are any unsubmitted tax items. It also generates a tax submission form that is required during PP30 submission to the Revenue Department.

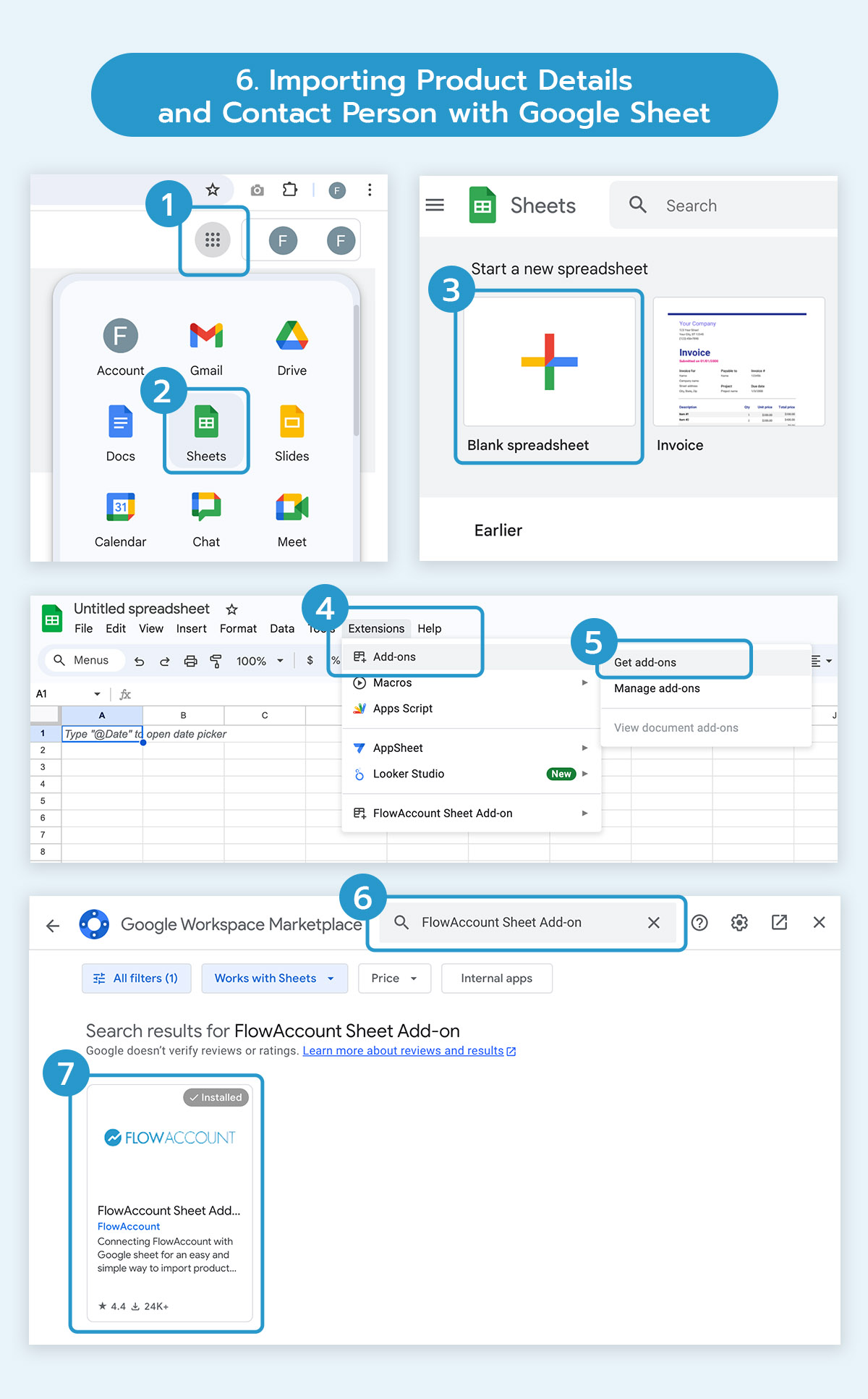

6. Importing Product Details and Contact Person with Google Sheet

If you are using an Excel file to record product details and business partners, you can easily import the data into FlowAccount with Google Sheets under the Add-ons feature. It allows over 500 transactions at a time. Business owners can create purchase and sale documents or manage stocks and search for client information easily without having to type them down one by one.

7. FlowAccount Mobile Application

If your business is mostly on mobile or you need flexibility for accounting and documents, you can use FlowAccount application on your smartphone for business administration anytime and anywhere. When you are not with your laptops/PCs, you can access to income and expense graph, create purchase and sale documents, record expenditures, and check/record stocks easily.

8. FlowAccount Payroll for Easy Payroll

Special benefits for business owners with small team members where you can have access to payroll features without any charges! Under this feature, you can transfer compensation to your employees, both daily and monthly, and it will also calculate social securities and withholding tax, record employee profiles, generate payslips, and summarise payroll into a dashboard for you.

In addition, if you are on a 30-day free-trial Pro Business package, you can also use a template file for payroll with Kbank, SCB, and BAY. The system will connect with K-Cash Connect Plus powered by Kbank which will help you with payment approvals for multiple employees at a time.

All of these 8 features from the free package are made available for new entrepreneurs, online business owners, or freelance. If you apply today, you will get access for 1 user with free consultation from experts since program installation and you can also apply to our 30-day free-trial Pro Business package!

Trust FlowAccount and allow us to be your true business partner. Anytime. Anywhere.

About Author

Certified Public Accountant (CPA) Thailand with experience as an external auditor for listed companies who aspires to make accounting easy and accessible for everyone.

Apply to be a writer for FlowAccount here.