| A VAT registrant who is doing a business in Thailand as a retailer or a service provider to a large number of people is entitled to issue an abbreviated tax invoice. Check out the full article to learn more about abbreviated tax invoice. |

We have already talked about full format tax invoice (read about full format tax invoice in “Tax Invoice”)

In this article, we will explore more on the “Abbreviated Tax Invoice (ABB)” which is commonly seen in our daily life.

The abbreviated tax invoice (ABB) is an important document for retailers that directly sell to consumers or provide services to a large number of people.

Who has the Rights to Issue the Abbreviated Tax Invoice

- VAT registered retailers who sell directly to consumers. The client must be the end user. Examples of retailers are convenient stores, stall shops, grocery stores, pharmacies and department stores.

- VAT registered service providers to a large number of people such as restaurants, hotels and cinemas.

เลือกอ่านได้เลย!

ToggleThe Revenue Department Approval is Required to Issue the Abbreviated Tax Invoice

If you are a VAT registered person or entity that wants to use a cash register machine to issue abbreviated tax invoices, you need to submit a request for approval to the Director-General of the Revenue Department at the Revenue Department.

If you have several places of business, the value added tax registration application must be made at the local Amphur office where the headquarters is located.

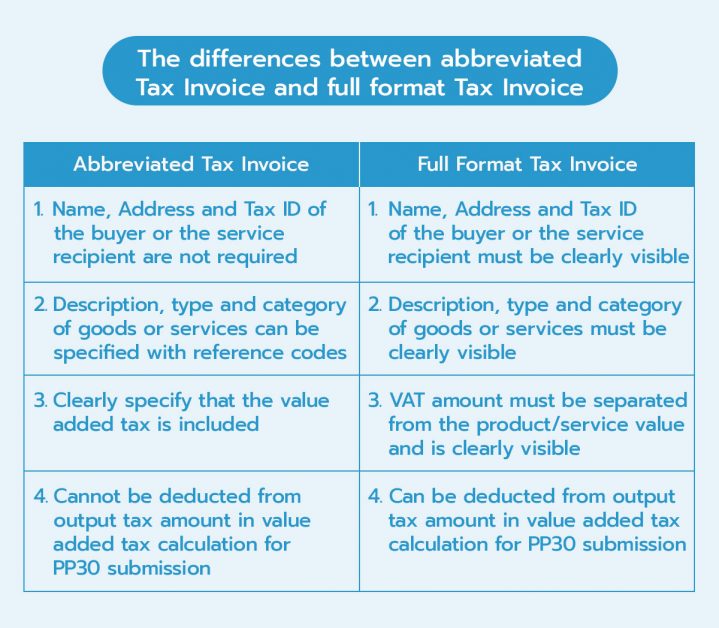

However, a full format tax invoice must be issued upon the buyer or the service recipient’s request. Full format tax invoice is important for customers who are also VAT registered persons or entities as they need it to be able to refund or deducted from their output tax. With an abbreviated tax invoice, the value added tax amount will become a prohibited input tax.

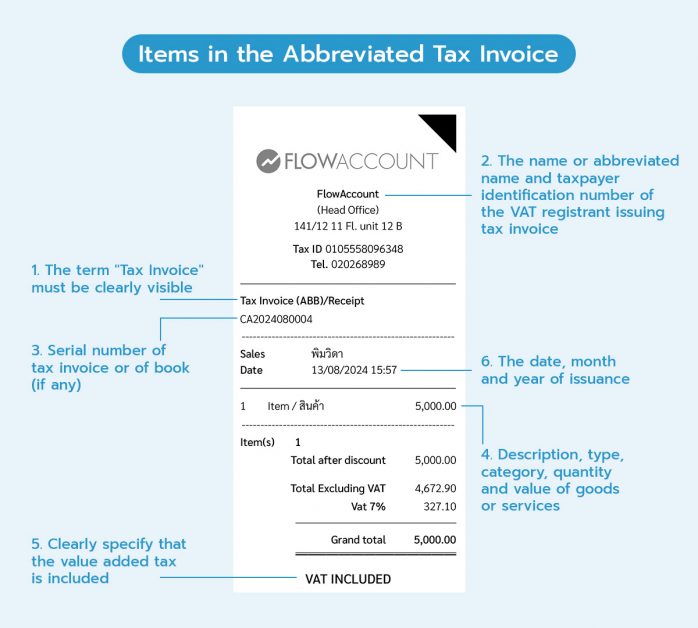

- The term “Tax Invoice” must be clearly visible

- The name or abbreviated name and taxpayer identification number of the VAT registrant issuing tax invoice

- Serial number of tax invoice or of book (if any)

- Description, type, category, quantity and value of goods or services

- Clearly specify that the value added tax is included

- The date, month and year of issuance

The abbreviated tax invoice is much more flexible than the full format tax invoice. On top,there are several exceptions to accommodate VAT registrants who are doing business in Thailand as a retailer or a service provider to a large number of people.

- In case of selling goods or providing services that the tax base never reached 300,000 Baht per month or selling with carts or in small shops, including shows, sports or contests that are organised to collect money from audiences, VAT registrants are not required to issue tax invoice for sale of goods or services of less than 1,000 Baht per time. Daily sales amount can be accumulated to issue an abbreviated tax invoice once at the end of the day to record in the output tax report.

- Petrol stations are not required to issue tax invoice for sale amount of less than 1,000 Baht a time. However, a tax invoice must be issued upon the buyer or the service recipient’s request.

- In the case of selling products or providing services to the same customer multiple times a day, these transactions can be accumulated to issue a tax invoice once at the end of the day.

- VAT registrants who issue abbreviated tax invoices do not need to specify names of the buyer or the service provider in the output tax report.

The differences between abbreviated tax invoice and full format tax invoice

There are several details and requirements on the issuance of both abbreviated tax invoice or full format tax invoice. To make issuing these documents simple, FlowAccount supports abbreviated tax invoice creation. Try it out for free here.

Key points to remember in issuing tax invoice are

- We must have the rights to issue

- The required information must be accurate and complete

- Issue at the right time

The Abbreviated Tax Invoice (ABB) offers a practical and efficient solution for VAT-registered businesses in Thailand, particularly those serving large numbers of consumers. While ABBs simplify the invoicing process by omitting detailed buyer information and allowing for flexible sales reporting, businesses must ensure they meet the necessary requirements and seek approval from the Revenue Department. For VAT-registered customers, a full tax invoice remains essential for tax deductions. By adhering to these guidelines, businesses can streamline their tax processes while remaining compliant with Thai VAT regulations.

About Author

Certified Public Accountant (CPA) Thailand with experience as an external auditor for listed companies who aspires to make accounting easy and accessible for everyone.

Apply to be a writer for FlowAccount here.