| Effective business documentation is vital for smooth operations and clear communication. From managing transactions to ensuring regulatory compliance, understanding the purpose and use of various documents—such as invoices, delivery notes, and credit notes—is essential. This article will guide you through these key business documents, explaining when and how to use each one to streamline your processes and maintain accurate records. Let’s explore how these documents can help you run your business more efficiently. |

Business Document in Thailand

Whether you are a seasoned entrepreneur or just starting out, understanding the different types of business documents and their specific uses is crucial. Each document plays a distinct role in the business process, from initiating transactions and managing financial records to ensuring compliance with regulatory requirements.

In this article, we will explore various key business documents, including invoices, delivery notes, credit and debit notes, and more. We’ll explain their purposes, when to use them, and important considerations to keep in mind.

Understanding these documents not only helps in maintaining proper records but also enhances your ability to manage business operations efficiently. Let’s dive into each document and see how they contribute to the overall functioning of a business.

เลือกอ่านได้เลย!

ToggleQuotation

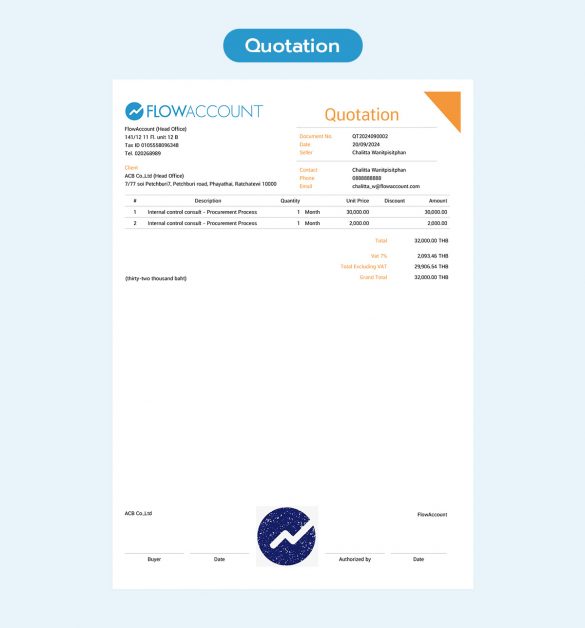

A quotation is a document issued by a business to a customer (buyer) to provide the customer with a price estimate for goods/services, including various terms, before they decide to purchase. Thus, a quotation helps us communicate the anticipated price or the cost of a job to our customers.

- When to Use It: Send a quotation to a customer when they inquire about the cost or specific pricing for a particular job or product.

- Precautions: Do not accidentally send a quotation to a customer when you intend to issue an invoice or collect payment. That is the role of the invoice or billing note.

Learn more in Quotation

Invoice

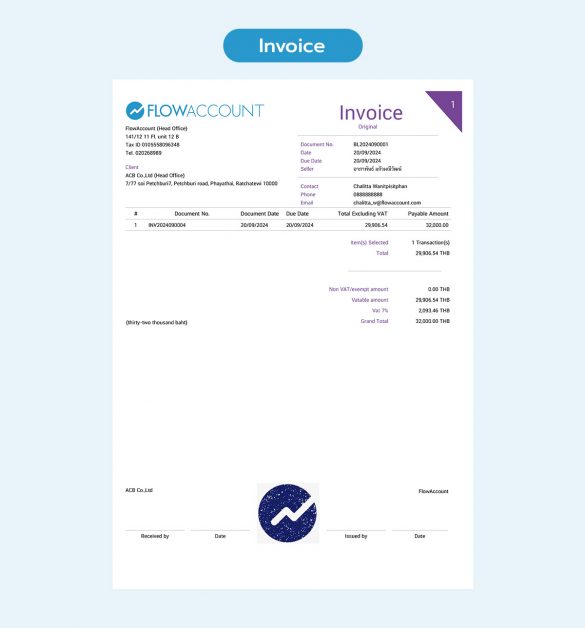

An invoice is a document sent to a customer when we need them to pay for goods or services that we have completed.

- When to Use It: When we have completed a task for a customer, we may need to send an invoice to inform the customer of what they need to pay for, how much, and when.

- Precautions: However, it should not be used for negotiating prices with customers. That would be the role of a quotation.

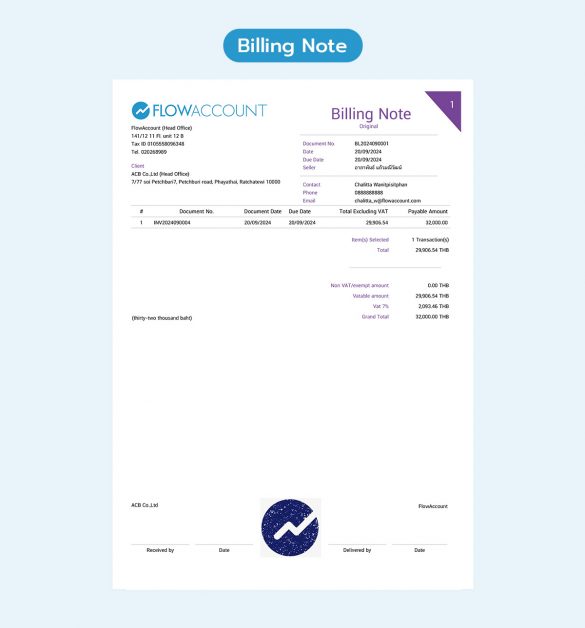

Billing Note

A billing note is a document issued by a business to inform the customer of the amount they need to pay and to serve as supporting documentation for the payment.

- When to Use It: It is used to notify the customer of the amount due for goods or services. It may also include scheduling for cheque collection or payment methods.

- Precautions: A billing note is merely a notification and cannot be used as proof of payment like a receipt or tax invoice.

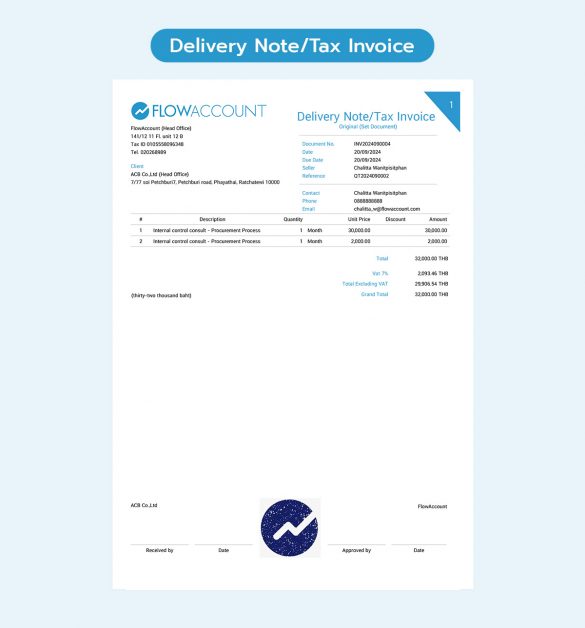

Delivery Note/Tax Invoice

A delivery note/tax invoice is used to communicate with the customer that we have delivered the goods according to the agreed conditions and quantities.

- When to Use It: When we deliver goods to a customer, we should send a delivery note/tax invoice to inform them about the details of the goods received, including quantity and value. The customer should sign to confirm receipt of the goods as per the agreed terms.

- Precautions: It should not be used to confirm payment receipt from the customer or for price negotiations. Generally, a delivery note/tax invoice is used to tell the details of items, quantity and value. In some businesses, it may only include details of items and quantity for internal inventory control.

Note: A tax invoice can only be issued if VAT registration has been completed.

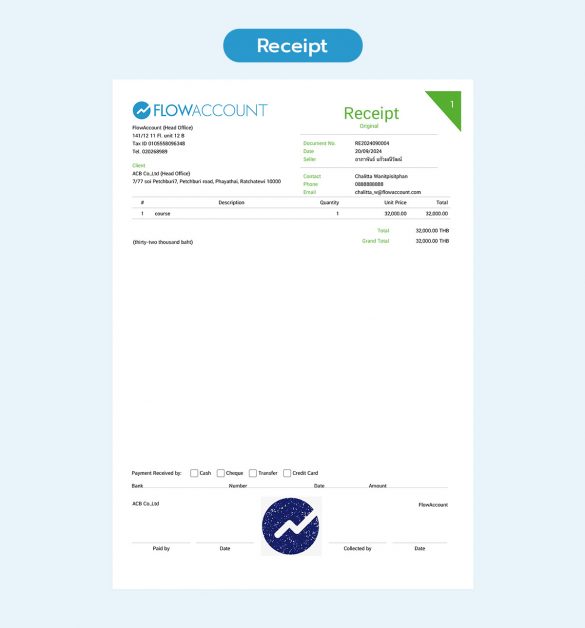

Receipt

A receipt allows us to inform the customer that we have received payment for the goods or services billed in the invoice. For service businesses, it will be used as invoice/receipt.

- When to Use It: On the day the customer makes the payment, our role is to issue a receipt to confirm that we have received the payment or settled the amount due. However, you may also issue an invoice along with a receipt in a single document.

- Precautions: If you have not yet received payment from the customer but need to notify them of the amount they owe, you must only use an invoice or a billing note.

Note: For service businesses that are VAT registered, a tax invoice/receipt should be used.

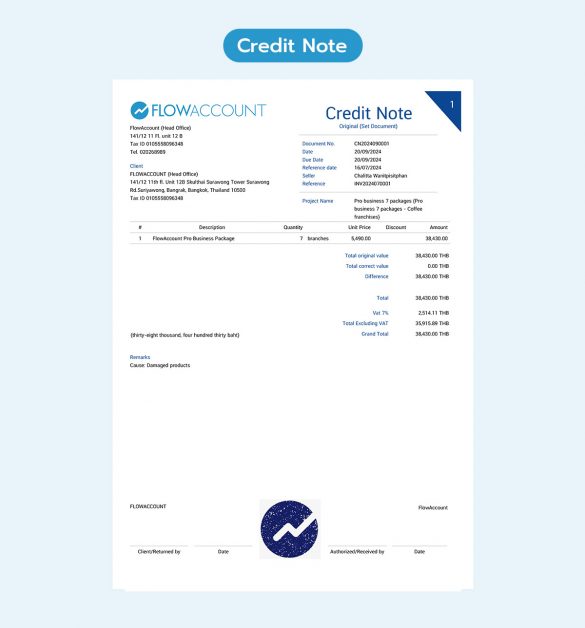

Credit Note

A credit note is a type of tax invoice issued by the seller or service provider when the quantity of goods or the value of the services is less than what was agreed upon, or if there was an error in the price calculation (higher) than what was agreed.

- When to Use It: When goods are delivered in incomplete quantities or if there was a pricing error (higher than agreed), a credit note should be issued in the same month as the tax invoice for the incomplete delivery or calculation error. If it cannot be issued in the same month, it can be issued in the following month. After issuing a credit note, it must be included in the tax calculations for both purchase and sales tax in the same month the credit note is issued.

- Precautions: Businesses not registered for VAT cannot issue credit notes. A credit note can only be issued if a tax invoice has been issued previously and it is intended to reduce the amount from that invoice. Even simplified tax invoices can be subject to credit notes, but the names of the buyer or the service recipient must be fully included.

Debit Note

A debit note is a type of tax invoice issued by the seller or service provider when the quantity of goods or the value of services exceeds what was agreed upon, or if there was an error in the price calculation (lower) than what was agreed.

- When to Use It: When goods are delivered in excess or if the price calculation for goods or services is lower than agreed, a debit note should be issued promptly in the same month as the tax invoice that was issued at a lower amount. If it cannot be issued in the same month, it can be issued in the following month. After issuing a debit note, it must be included in the tax calculations for both purchase and sales tax in the month the debit note is issued.

- Precautions: Businesses not registered for VAT cannot issue debit notes. A debit note can only be issued if a tax invoice has been previously issued and it is intended to increase the amount from that invoice. Even simplified tax invoices can be subject to debit notes, but the names and addresses of the buyer or the service recipient must be fully included.

Now that we have explored the above 7 types of business documents, these documents are available under the “Sell” menu. FlowAccount accounting system helps business owners reduce the time required to handle these documents. Try a free 30-day trial here.

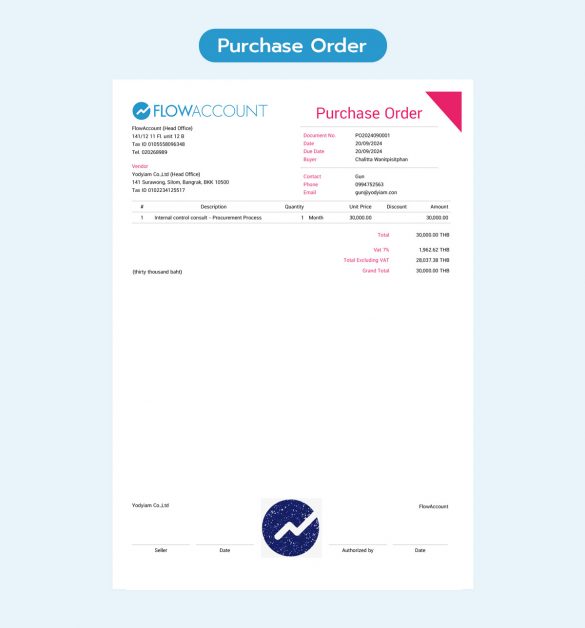

Purchase Order

A purchase order is a document used to communicate preliminary agreements for desired goods and services.

- When to Use It: This document is typically received from customers to notify the preliminary agreement for the goods and services they require. Conversely, if we need to purchase goods or hire services, we issue this document to inform the seller of the goods or services we want. It is used as supporting documents with the invoice, including the delivery note/tax invoice in procurement management.

- Precautions: Do not use the purchase order as a replacement for the delivery note or tax invoice. A purchase order is merely a document indicating the preliminary intention to purchase or hire, and does not imply receipt of the goods or services as agreed.

Note: If used to notify = we are buying goods (we are the customer) / if received as notification = the customer is buying our goods (we are the seller).

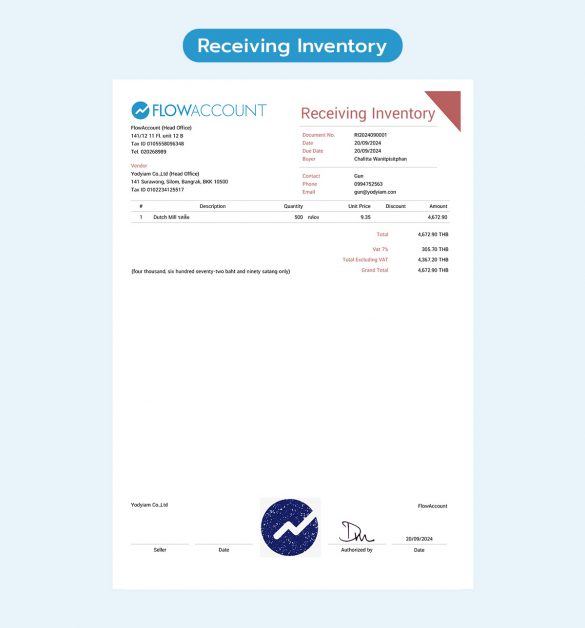

Receiving Inventory

A goods receipt is a document that helps us verify and confirm the quantity of ordered goods against the quantity received from the seller.

- When to Use It: It is used to check and confirm that the quantity and value of the goods match the seller’s delivery note. Remember to sign both the goods receipt and the supplier’s delivery note to provide proof of receipt.

- Precautions: A goods receipt should not be used to place orders for goods. That is the purpose of the purchase order.

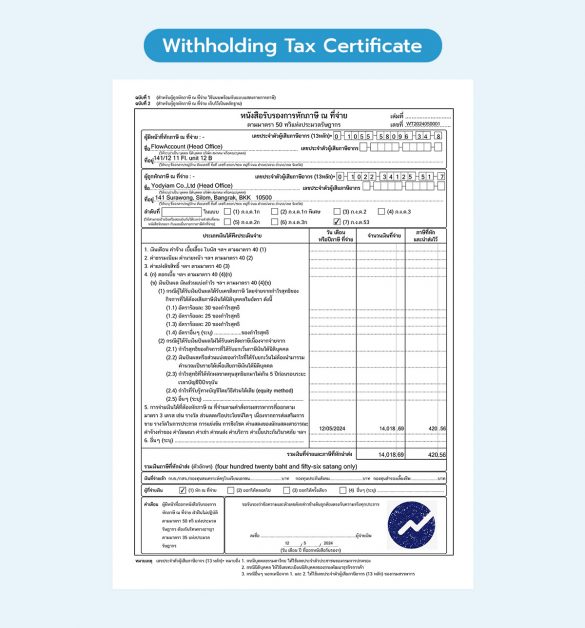

Withholding Tax Certificate

A withholding tax certificate is a document used by a company to verify that a portion of the payment has been withheld and submitted to the government.

- When to Use It: This document must be issued by the company each time it pays for services to others, where a portion of the payment has been withheld and submitted to the tax authorities according to their regulations. The withholding rates vary depending on the type of expense.

- Precautions: It cannot be used as a substitute for an invoice/tax invoice or a receipt from the seller or service provider.

Now that you understand and see the differences between each type of “business document” more clearly, if you’re ready and want to try using these documents, you can give the FlowAccount accounting software a try. With FlowAccount, you can easily, conveniently, and quickly generate these documents. You can also sign up for a free trial without needing a credit card.

About Author

Certified Public Accountant (CPA) Thailand with experience as an external auditor for listed companies who aspires to make accounting easy and accessible for everyone.

Apply to be a writer for FlowAccount here.