| To keep a business running smoothly, it’s crucial to understand how money flows in and out. A cash flow statement shows where your cash is coming from and going to, while working capital tells you how much short-term money you have to cover daily expenses. This article will explain how to read a cash flow statement, what working capital is, and how to manage both to keep your business healthy and successful. |

What is a Cash Flow Statement?

A cash flow statement is a financial report that explains the sources and uses of cash within a business, showing how cash flows in and out through different activities.

This report tracks the movement of cash over a certain period, such as how much cash the business had at the start of the year, how much came in and out during the year, and how much was left at the end.

เลือกอ่านได้เลย!

ToggleUnderstanding the Three Activities in a Cash Flow Statement

Cash inflows and outflows are divided into three main activities. To fully understand a cash flow statement, we need to understand these three activities.

1. Operating Activities (Cash Flow from Operating: CFO)

These are the core activities that generate revenue and expenses for the business, which include both inflows (positive) and outflows (negative).

For example:

+ Cash inflows from sales of goods or services

– Cash outflows for purchasing raw materials, paying for services, and employee wages

A simple way to measure performance is to observe that the net cash from operating activities should always be positive. This indicates that the core business generates more cash inflows than outflows over time.

2. Investing Activities (Cash Flow from Investing: CFI)

These activities involve investments in non-current assets like land, buildings, and equipment or other forms of investments. Examples of inflows (positive) and outflows (negative) include:

– Cash outflows for investing in subsidiaries

– Cash outflows for purchasing land or factories

+ Cash inflows from selling subsidiaries

+ Cash inflows from selling land or factories

Typically, this section often shows negative cash flows due to large, infrequent investments. However, if these investments later generate more cash inflows from operations than the amount invested, it is a positive sign for the business.

3. Financing Activities (Cash Flow from Financing: CFF)

These activities are related to the business’s financing strategies, usually through loans or equity investments. Examples of inflows (positive) and outflows (negative) include:

+ Cash inflows from borrowing money

+ Cash inflows from increasing capital

– Cash outflows for repaying loans

What is Working Capital?

Working capital refers to short-term reserve funds that a business needs to ensure smooth daily operations.

The more working capital a business has, the easier it is to turn assets into cash and pay off debts on time.

However, if working capital is low, the business is at risk. It may face liquidity issues, making it unable to meet debt obligations. This situation is common among new businesses that fail to set aside sufficient reserves, which could eventually lead to failure.

How to Assess Working Capital in Financial Statements

Once we understand the meaning and importance of working capital, let’s look at a simple way to evaluate it.

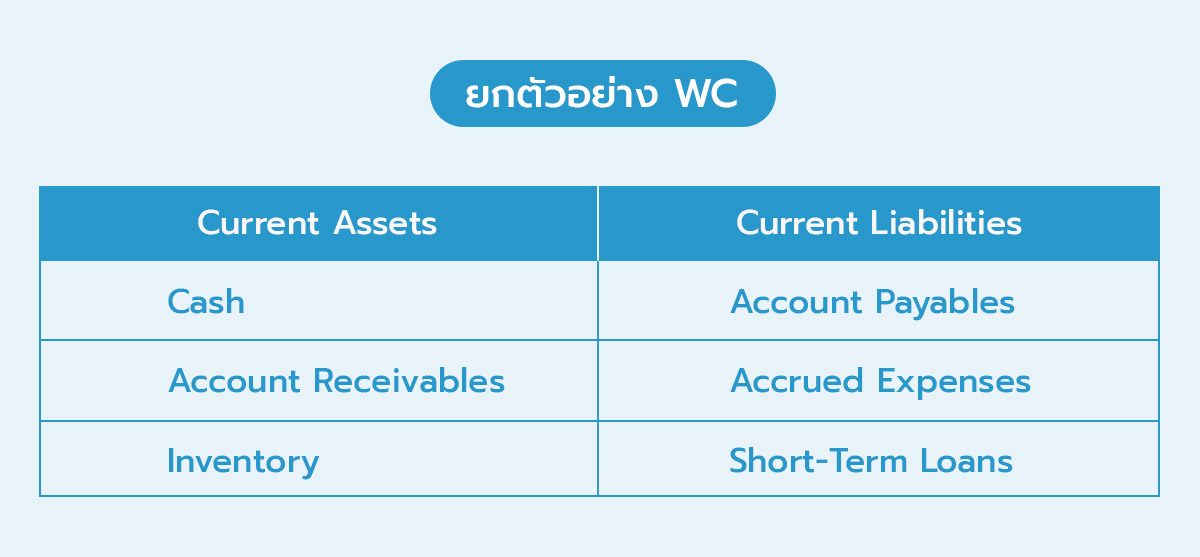

When assessing working capital, we compare “current assets” to “current liabilities,” which can be easily viewed from the financial position statement.

This section may show both cash inflows and outflows depending on how the business raises and repays funds over time.

Current Assets

Current assets typically consist of the following three main components:

- Cash: This is the most liquid asset, which we all know can quickly pay off debts.

- Accounts Receivable: These arise from sales or services provided on credit. For example, after selling a product, payment is received after 15 days. This is shown as an asset on the balance sheet. Although less liquid than cash, it still counts as working capital.

- Inventory: These are products still in stock and not yet sold. Inventory is less liquid than cash and receivables, but it’s a good source of working capital for manufacturing and trading businesses.

All of these current assets can serve as sources of working capital, differing only in how quickly they can be converted into cash.

Current Liabilities

Current liabilities are obligations the business must pay in the near future (within one year). Common examples of current liabilities include:

- Accounts Payable: Arising from goods or services purchased but not yet paid for. Often, businesses get credit terms to delay payments as agreed.

- Accrued Expenses: These are expenses that have been utilised in the business but not yet paid, such as unpaid wages, unpaid rent, etc.

- Short-Term Loans: Naturally, if a loan is short-term, it must be repaid on time, along with interest owed to the bank or lender, such as business credit card debt or overdraft (OD).

Current liabilities are the opposite of current assets; having many current liabilities means the business must pay off many debts in the near future.

How to Increase Working Capital

If you assess your working capital and find it insufficient or negative, here are several ways to increase it:

- Follow up with debtors to ensure timely payments or offer discounts to encourage quicker payments.

- Manage inventory efficiently by not stockpiling excess goods.

- Speed up sales by offering promotions or freebies to attract customers.

- Negotiate with creditors for longer credit terms.

- Be mindful of penalties from late loan payments or taxes.

- Reduce unnecessary monthly expenses.

In conclusion, every business owner should understand working capital. Although it doesn’t directly relate to a business’s profits, it functions like the lifeblood that keeps the business running. Sometimes, it can even determine whether the business will survive in the long term.

To avoid sudden failure, it’s essential to manage working capital adequately alongside profits.

You can use the FlowAccount online accounting software to create basic financial statements, which helps business owners stay informed about their business’s health in real time, without waiting for year-end financial closing.

About Author

Certified Public Accountant (CPA) Thailand with experience as an external auditor for listed companies who aspires to make accounting easy and accessible for everyone.

Apply to be a writer for FlowAccount here.